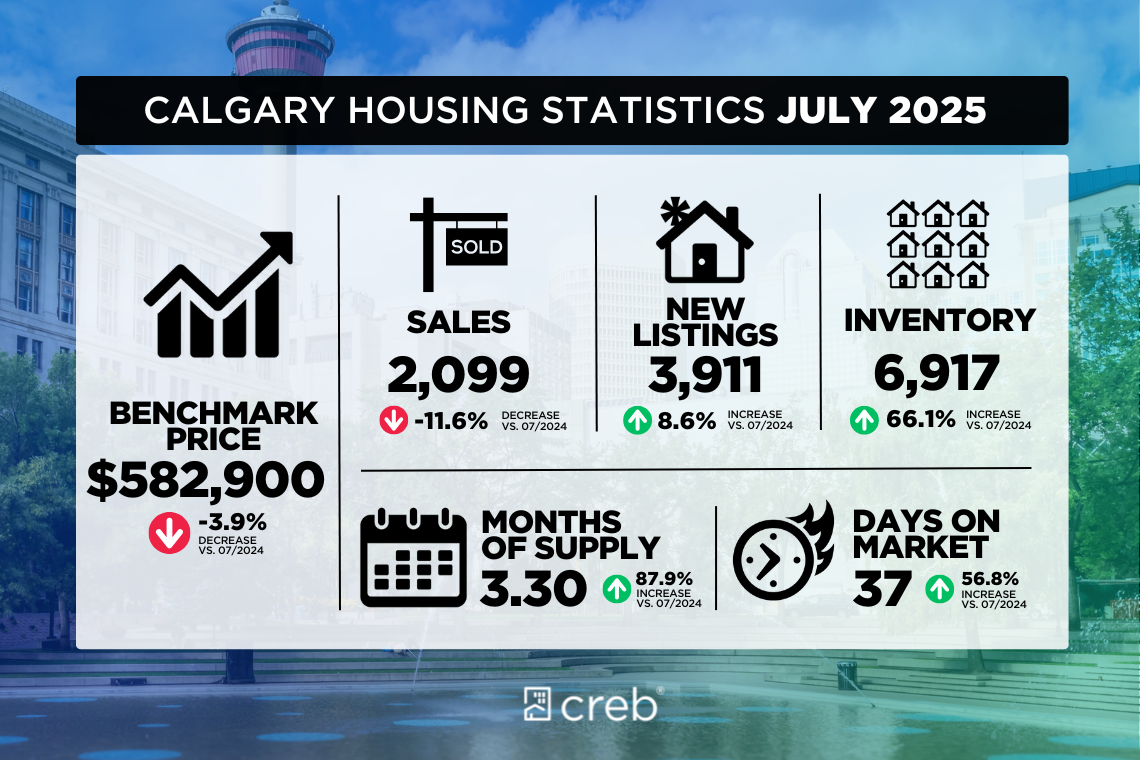

October brought meaningful adjustments to the Calgary real estate market, offering both clarity and new opportunities for homeowners preparing to sell. Inventory levels eased slightly this month as new listings pulled back and sales improved. With 6,471 units in inventory and 1,885 sales, months of supply decreased to 3.43, down from four months in September.

This movement signals a more balanced environment for detached and semi-detached homes, while row and apartment-style properties continue to face elevated inventory levels. According to CREB® Chief Economist Ann-Marie Lurie, higher rental availability and easing rents have softened ownership demand in these categories, contributing to record-high October inventory for both segments.

Pricing Trends Sellers Should Watch

The unadjusted benchmark price for Calgary real estate sits at $568,000, down just under 1% from last month and over 4% lower than October 2024. The largest year-over-year adjustments occurred among row and apartment-style homes, with prices easing by 6% and 7% respectively.

For homeowners thinking about listing, this type of market makes strategic preparation essential. Smart pricing, detailed presentation, and clear positioning can help your property stand out—especially within segments experiencing higher supply.

What This Means for Sellers

Detached and semi-detached properties continue to perform well in relatively balanced conditions. Sellers in these categories remain well-positioned to attract serious buyers, provided they enter the market with a data-backed strategy.

If you’re considering selling in the next 3–12 months, now is the time to start planning. A detailed pricing analysis, tailored marketing strategy, and preparation checklist can help you maximize your selling outcome even in a market that is adjusting month to month.

A Note for Buyers and Investors

Higher supply in the row and apartment markets is creating opportunities that haven’t existed in several years. Buyers and investors looking for value may find this a favourable moment to enter the market.

Let’s Discuss Your Next Move

If you're a Calgary homeowner curious about your property’s current value—or you’re wondering how these trends affect the sale of your home—I’m here to guide you through every step. Reach out anytime for a personalized market assessment.